how much is the nys star exemption

It is necessary that you own a home and have an income of 50000 or less owner and their spouse together STAR exemptionthis is a reduction on your school tax bill. Form RP-425-B Application for Basic STAR Exemption.

Star Program New York Property Tax Relief Credit Karma

Basic STAR averages about 800 a year and Enhanced STAR is about 1400 a year.

. The enhanced STAR exemption will provide an average school property tax reduction of at least 45 percent annually for seniors living in median-priced homes. Whether you receive the STAR exemption or the STAR credit there are two parts to the STAR program. The benefit is estimated to be a 293 tax reduction.

Senior citizens whose annual. The enhanced STAR exemption will provide an average school property tax reduction of at least 45 percent annually for seniors living in median-priced homes. You can receive the STAR credit if you own your home and its your primary residence and the combined income of the owners.

The Enhanced STAR savings amount for this property is 1000. The 2022 STAR exemption amounts are now available online except for school districts in Nassau. Seniors will receive at least a 50000 exemption from the full value of their property.

You must register with NY State online at wwwtaxnygovstar or over the phone at 518-457-2036. The amount of the STAR credit can differ from the STAR exemption savings because by law the STAR credit can increase by as. Annually for each school district segment the amount of savings as a result of the STAR exemption cannot exceed the savings.

Basic STAR is for homeowners whose total household income is 500000 or less. Enhanced STAR is for homeowners 65 and older whose. If you are applying for.

The STAR savings is substantial. The maximum star exemption savings. If you earn less than 500000 and own your.

BASIC STAR and ENHANCED STAR. 500000 or less for the star credit. STAR exemption amounts and maximum savings now available online.

In 2019 the checks will be as. STAR credit and exemption savings amounts. Basic STAR Exemption Basic STAR is available to anyone who owns property.

Enhanced STAR is available for seniors with incomes. The Maximum Enhanced STAR exemption savings on our website is 1000. You can use the check to pay your school taxes.

Residents of New York City or Nassau County. New York City residents Exemption forms and applications Call 311. Maximum 2022-2023 STAR exemption savings.

The Maximum Enhanced STAR exemption savings on our website is 1000. You need to have. Enhanced STAR exemptions are calculated the same way except the base amount for the Enhanced STAR.

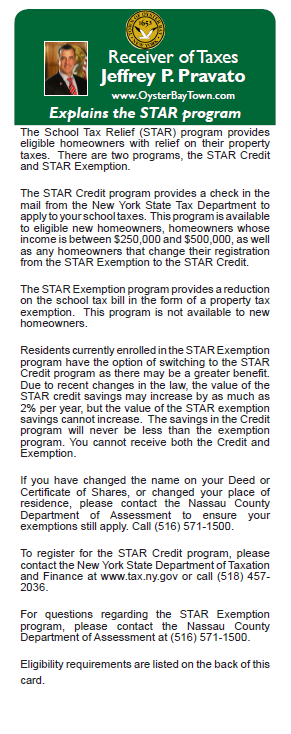

See Late Enhanced STAR applications due to good cause. STAR is the New York State School Tax Relief program that provides an exemption from school property taxes for owner-occupied primary residences. Basic star averages about 800 a year and enhanced star is about 1400 a year.

Who is eligible for BASIC. The total amount of. The formula below is used to calculate Basic STAR exemptions.

The New York School Tax Relief Program also known as STAR provides New York homeowners with partial exemptions for school property taxes.

Old Star Discontinued For New Homebuyers Roohan Realty

The School Tax Relief Star Program Faq Ny State Senate

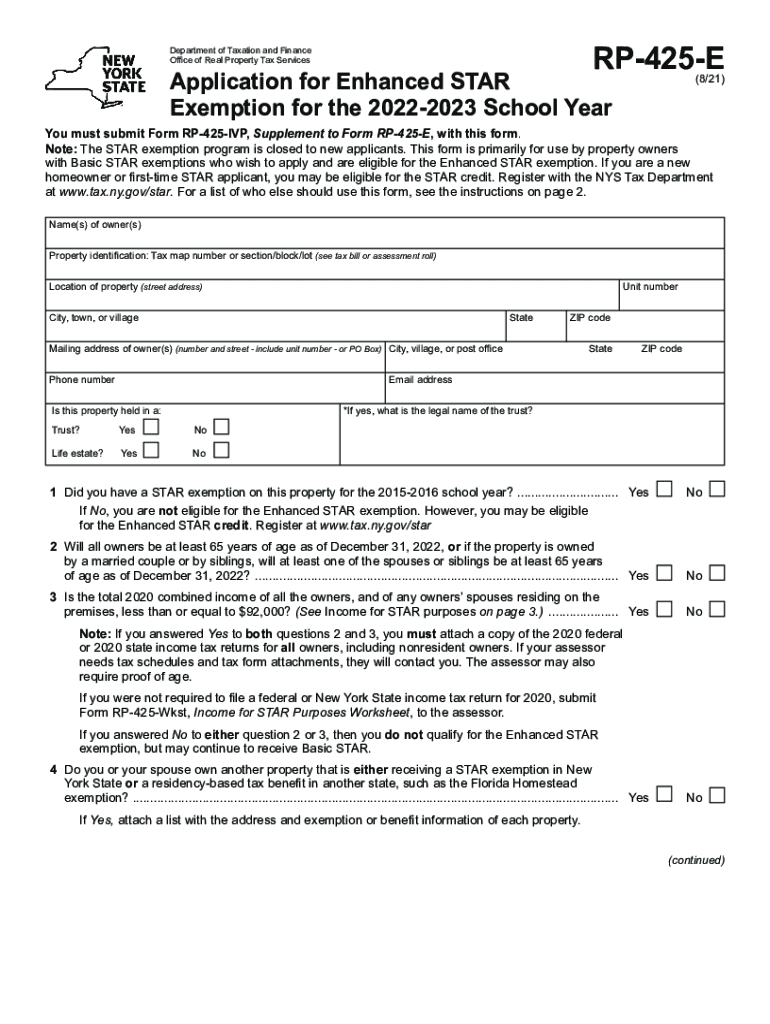

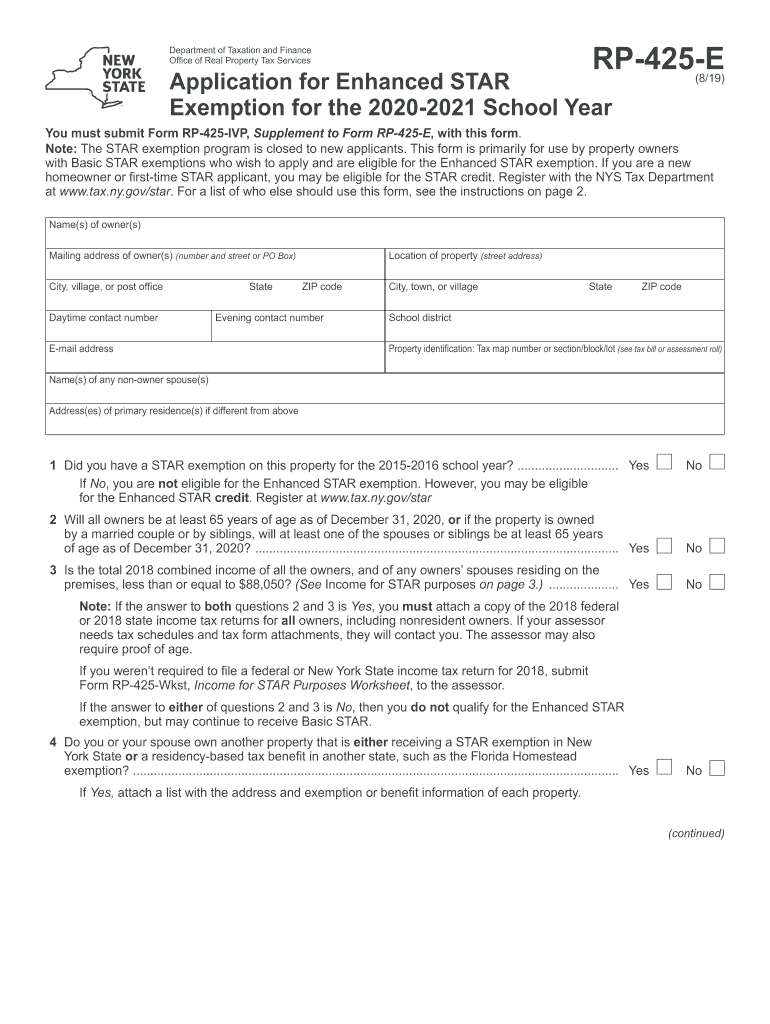

Form Rp 425 Ivp Fill Out Sign Online Dochub

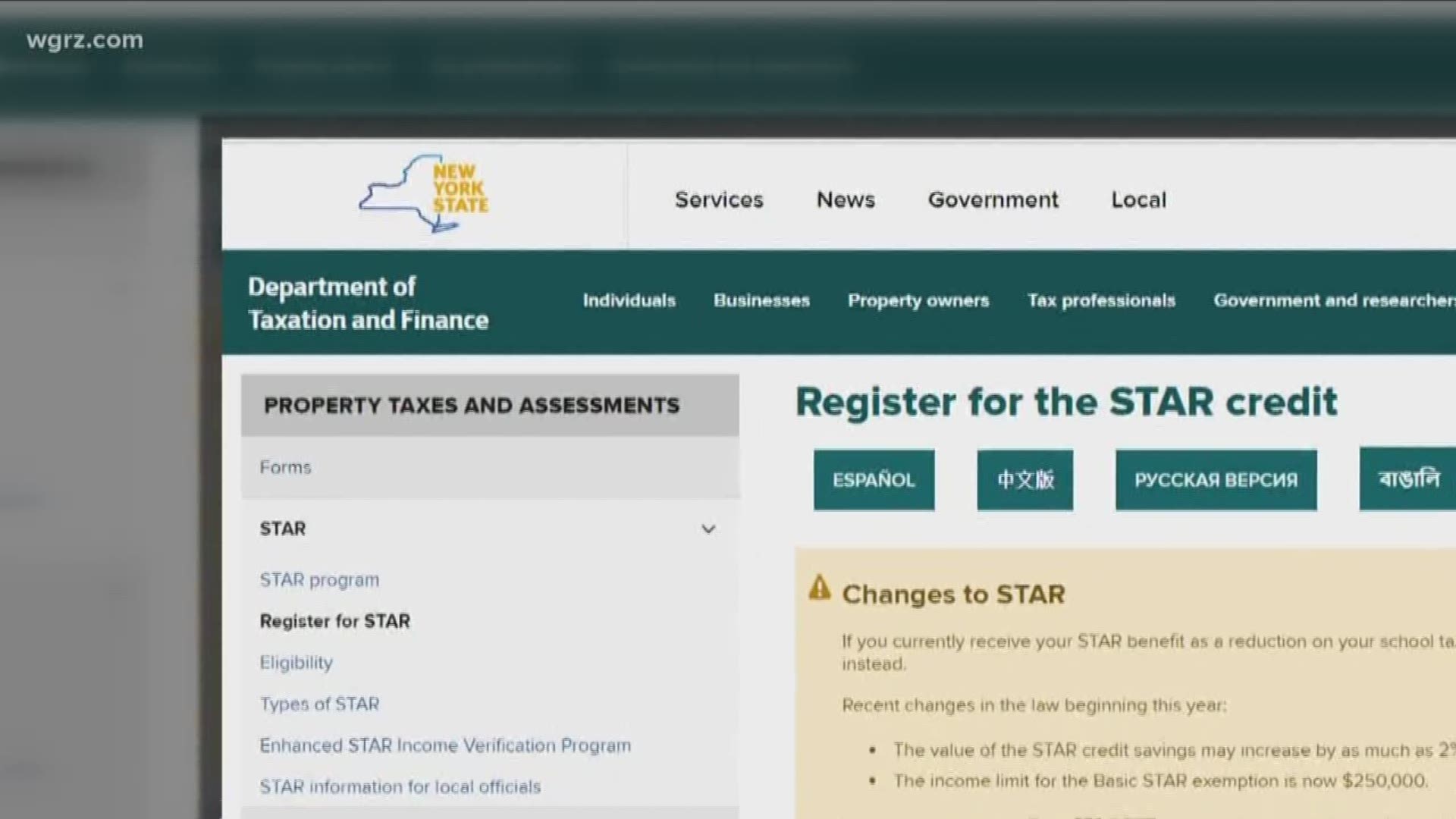

How To Apply For New York State S Star Credit Program

Ny 425 Fill Out Sign Online Dochub

Nys Star Program Long Island House Savings Youtube

Many Homeowners Face A Choice On How To Best Get Their Star Wgrz Com

Tax Exemptions Town Of Oyster Bay

New York State Assembly How The Star Program Can Lower Your Property Taxes

If You Cheat The Star Program In Ny You Could Lose The Tax Breaks

Donald Trump Star Exemption And Tax Returns The Public

2018 Question And Answers About Enhanced Star Ny State Senate

Q A How Star Exemption Is Changing

Star Property Tax Credit Make Sure You Know The New Income Limits Greenbush Financial Group

What Is The Nyc Senior Citizen Homeowners Exemption Sche

New York Seniors Reminded To Upgrade Star Exemption